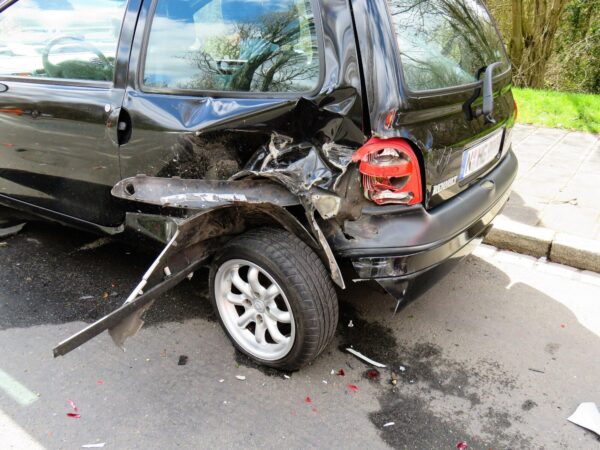

Auto accidents can be stressful and confusing. After the shock of the crash, one of the biggest questions people face is how to handle the settlement process. Understanding your options can help you make better choices and get the compensation you deserve.

In this article, we will explain the main types of auto accident settlements and what you should know about each. Whether you want to settle quickly or fight for a higher amount, knowing your options is important.

What Is an Auto Accident Settlement?

An auto accident settlement is an agreement between you and the other party involved in the crash, or their insurance company. This agreement decides how much money you will get to cover your damages, such as medical bills, car repairs, and lost wages.

Settlements help avoid a long court battle. Instead of going to trial, both sides agree on a payment. This can save time and money but requires careful consideration.

Types of Auto Accident Settlements

There are several settlement options available after an auto accident. Each has its pros and cons depending on your case.

Informal Settlement

This is the most common type. It happens when you or your lawyer negotiate directly with the insurance company. You talk about the accident, show proof of your damages, and ask for a fair amount.

If both sides agree, you sign a settlement agreement and receive your money. Informal settlements are usually faster but may offer less money than going to court.

Structured Settlement

A structured settlement is a payment plan that spreads your settlement money over time. Instead of one lump sum, you get smaller payments regularly, like monthly or yearly.

This can be helpful if your injuries require long-term care or you want to protect your money from being spent too quickly. However, it might take longer to get all your money.

Lump-Sum Settlement

In this option, you get all your money in one payment. Lump-sum settlements give you full control of the funds immediately. You can pay medical bills, repair your car, or cover other expenses right away.

Keep in mind that a lump-sum settlement might be lower than what you could get in court because it avoids the risks and costs of a trial.

What Can You Settle For?

When you settle an auto accident claim, your payment can cover many different costs:

- Medical bills and future medical care

- Lost income if you missed work

- Property damage (like car repairs)

- Pain and suffering or emotional distress

Knowing what to ask for can be tricky. You should keep detailed records and talk to a legal expert to make sure your settlement covers all your needs.

Should You Accept the First Offer?

Insurance companies often try to settle quickly and for less money. The first offer you get might be lower than what you deserve.

- Before accepting, consider these steps:

- Review the offer carefully

- Calculate your total losses and damages

- Talk to a lawyer, especially if the offer seems too low

Many people work with law firms in San Francisco to get advice and make sure they get a fair deal.

Take Charge of Your Settlement

Understanding your auto accident settlement options is key to getting fair compensation. Whether you choose an informal agreement, a structured settlement, or decide to go to court, knowing your rights will help you make smart choices.

Take the first step today – learn your options, gather your documents, and get the support you need to protect yourself after an auto accident.

Want more? Let us guide you through your next steps!