With the overwhelming number of Forex and CFD trading platforms available, how can one identify a broker that is not only compliant and regulated but also suitable for long-term, stable growth?

If you’re seeking more than just a trading account — if you’re looking for a platform that supports systematic development, offers diverse instruments, and ensures stable service — then XM[1] , a trusted global broker established in 2009 with over 5 million users worldwide, might be a strong candidate for your consideration.

This review will examine XM from five key dimensions:

- Platform background and global regulatory framework

- Business model and account structure

- Frequently asked questions by new users

- Comparison with challenge-based funding platforms

- XM’s independent rating on BrokerHive

Background & Regulatory Overview: XM’s Global Footprint

Founded in 2009, XM is part of Trading Point Holdings Ltd., an international broker offering multi-asset trading services. The platform currently serves over 5 million registered traders across more than 190 countries.

Global Regulatory Licenses

XM holds licenses from several reputable financial authorities, including:

- ASIC – Australian Securities and Investments Commission

- CySEC – Cyprus Securities and Exchange Commission

- DFSA – Dubai Financial Services Authority

- FSC – Financial Services Commission of Belize

This multi-jurisdictional regulatory coverage offers a solid framework for client fund protection, operational transparency, and enhanced platform credibility in global markets.

Business Model Deep Dive: Account Types & Product Coverage

As a broker specializing in Forex and CFD trading, XM operates primarily via MT4 and MT5 platforms. Its account offerings are structured to suit different trading stages, risk profiles, and strategic preferences — demonstrating both depth and flexibility in design.

Multiple Account Types for Every Trader Level

XM provides four main account types:

- Micro Account – Ideal for beginners; 1 lot = 1,000 units, offering lower exposure for learning trades with minimal risk.

- Standard Account – Designed for experienced traders; 1 lot = 100,000 units (standard volume).

- Ultra Low Account – Features ultra-low spreads (from 0.6 pips); particularly suitable for intraday traders and cost-sensitive strategies.

- Shares Account – Provides access to real U.S. stocks; available only for selected qualified clients.

With a minimum deposit requirement starting at just $5, XM significantly lowers the entry barrier for new users. Additionally, all account types use a floating spread + zero commission model, making transaction costs transparent and manageable.

Broad Range of Instruments for Diverse Strategies

XM’s product suite includes:

- Major and minor Forex pairs (e.g., EUR/USD, GBP/JPY)

- Global stock index CFDs (e.g., S&P 500, Nikkei 225, Hang Seng)

- Precious metals, commodities, and energy products

- Stocks and ETFs (available via the Shares Account)

This broad instrument coverage supports a variety of trading styles, including trend following, arbitrage, hedging, and volatility-based strategies.

Full Platform Compatibility & Seamless Multi-Device Experience

XM supports both MT4 and MT5 across web, desktop, and mobile (iOS/Android) platforms. The experience is smooth and well-optimized for all devices, with consistent charting tools and indicators across interfaces.

Key features include one-click trading, EA support, multi-chart windows, and low-latency execution — making the platform friendly for both manual and algorithmic traders.

What New Users Often Ask About XM

- Does XM support EA or algorithmic trading?

Yes. XM allows the use of Expert Advisors (EAs) and automated strategies on MT4/MT5. However, practices like abusive latency arbitrage may be restricted under the platform’s fair use policy. - Is the withdrawal process smooth? What methods are supported?

XM supports withdrawals via bank wire, credit/debit cards, Skrill, Neteller, and others. The process is transparent, with no hidden fees, and is generally reported as fast and reliable. - Is there Chinese-language support? Is the platform beginner-friendly?

Yes. XM offers a fully localized experience for Chinese-speaking users — including a Chinese website, customer service, and educational materials. New traders can learn via structured courses and tutorials. - Does XM offer growth programs for profitable traders?

While XM does not have a challenge model or tiered capital system, it provides long-term incentives through promotions, bonuses, and loyalty programs for active users. - Is a demo account available? Is it realistic?

Yes. All registered users can open a free demo account to test strategies or familiarize themselves with the platform. The demo closely mirrors live trading conditions and is useful for both beginners and experienced traders.

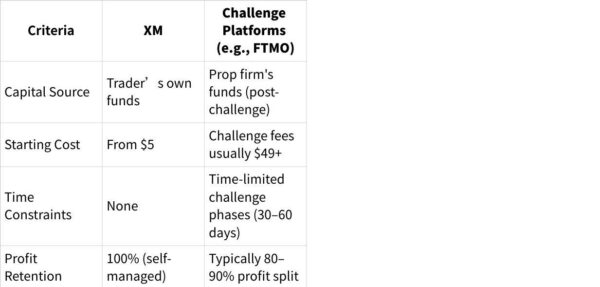

XM vs. Challenge-Based Funding Platforms: Which Is Right for You?

点击图片可查看完整电子表格

Summary:

XM operates as a traditional live trading broker, where traders manage their own capital, face no time constraints, and can build a sustainable trading system. In contrast, challenge-based platforms focus on performance-based funding but often have higher pressure, limited timelines, and less regulatory backing.

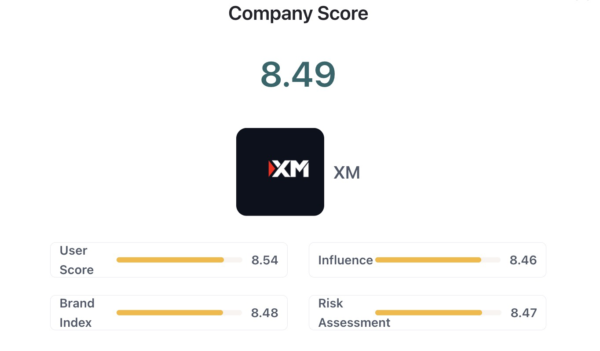

BrokerHive Independent Score: XM Earns 8.9 / 10

According to independent research by BrokerHive XM[2] , XM scores highly in platform reliability, regulatory transparency, product variety, and client services.

Category Scores:

- Regulatory Compliance: ★★★★☆

- Platform Stability: ★★★★★

- Cost Transparency: ★★★★☆

- Customer Support: ★★★★☆

- Product Coverage: ★★★★☆

Final Verdict: XM Is Ideal for Traders Prioritizing Stability

As global regulators tighten oversight of high-leverage instruments like crypto and derivatives, many traders are shifting toward regulated, secure, and institutionally backed platforms. XM has capitalized on this trend with its transparent operations, strong regulatory backing, and well-established global user base.

Regulatory integrity and platform stability are once again becoming key decision factors.

If you aim to build a sustainable, long-term trading strategy — rather than relying on short-term high-risk leverage models — then XM is a platform well worth your attention.

As a leading independent broker research institute, BrokerHive [3] provides neutral, data-driven insights across platforms — helping traders match with brokers that align with their strategy, experience level, and risk profile.

https://www.sdlytrade.com/en/broker/6835620772a01